Thinking about listing your home for sale? Great! Here are three important things you need to take a look at before you get going.

Step One: Clearing your Title

When was the last time you took a look at the title search for your property? Don’t list your home for sale unless you have done a recent title search and know what needs to be done to clear your title.

A title search tells you who the registered owners of the property are, and lists other people or entities who might have an interest in your property.

Other people can register charges, liens or judgments on your property without formally notifying you. This makes it important to see if anything has changed, or been added to your title since you bought the property.

Before you even list your property, you should get a current title search for your property, so you can see if you need to do any “clean up” work before you put the property on the market.

This is the legal equivalent of “decluttering”.

Some examples of things that might need cleaning up are:

- removing deceased owners from title

- clearing off old mortgages

- returning outstanding Duplicate Certificates of Title

- clearing Certificates of Pending Litigation and other liens or judgments

Removing deceased owners from title

You must remove any deceased owners from title before you sell the property. You should do this either before or when you list your home for sale.

If property was registered as true joint tenants, it’s a relatively straight-forward process to remove a deceased person from title.

Owning property as tenants in common, or under a bare trust, gets a little bit more complicated. Probate might be required.

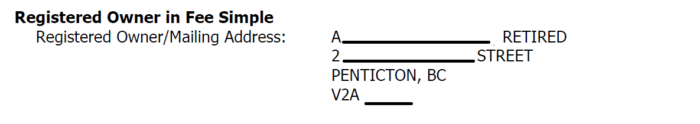

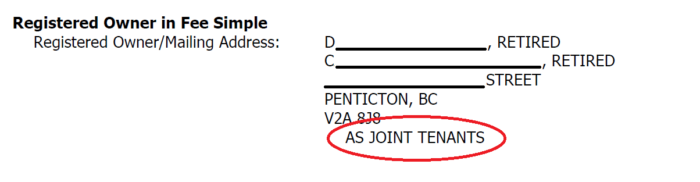

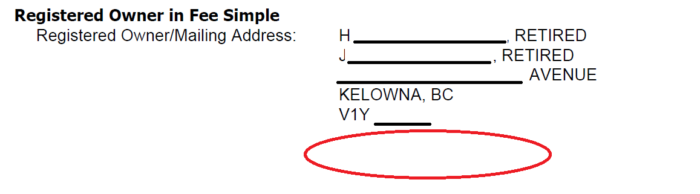

How do you tell? When you look at the title search, you will see a section called “Registered Owner in Fee Simple”. Here are three examples:

This is an example of a title registered in the name of one person by themselves.

Here’s a title registered in the name of two people as joint tenants.

This is an example of a title which is NOT registered in joint tenants – if the title doesn’t say “joint tenants”, that means the owners are registered as tenants in common.

If you have a deceased owner on title, contact us before you list your home for sale. We can help remove that person from title to the property.

Clearing old mortgages off before you list your home for sale

There are two parts to the paperwork for mortgages: banking documents and Land Title Office documents.

When you pay off a mortgage, the bank will give you a receipt for that payout. This proves you have cleared your debt with the bank. It will also give you a document (called a “Release”). You file this Release at the Land Title Office. This Release clears the mortgage from the Land Title Office records.

Many people pay their mortgage off at their bank, but then forget to get (or lose) this Release. A mortgage remains on title to your property until you file the Release for it at the Land Title Office.

You must provide “clear title” to someone who wants to buy your home.

We will need to remove any old mortgages from title. It can take several weeks to remove old charges from title. The sooner we get started, the better.

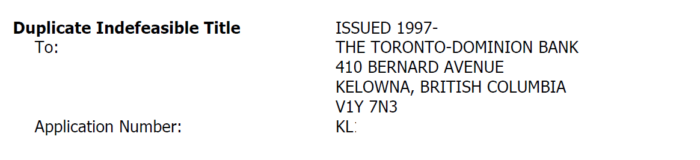

Returning Duplicate Certificates of Title before you list your home for sale

Some title issues can cause you real problems and delays – such as an outstanding duplicate certificate of title. If your duplicate certificate of title has been removed from the Land Title Office, you need to address this immediately. You cannot sell your home until this has been resolved.

So what is this duplicate certificate of title? It’s a document issued by the Land Title Office that freezes title to your home.

In BC, the provincial Land Title Office keeps all title deeds in their safekeeping. Individual owners never have original title deeds in their possession, so they never get lost or stolen.

But you can ask the Land Title Office to give you a duplicate certificate of your title. You must have clear title before you can do this.

Once the duplicate certificate of title has been issued out of the Land Title Office, your title is frozen. Because of this, “removing the duplicate certificate of title” is one way people protect their property against fraud.

You must keep this Certificate very safe. You might put it in your safety deposit box, in a bank vault (as security for a loan). Your basement is NOT a good option.

The Land Title Office will make a notation on your title showing where the title was sent.

You must resolve this issue before you can list your property for sale. If you have lost the duplicate certificate of title, it must be replaced. That process can take several months (and it will cost a lot).

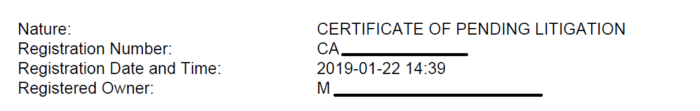

Certificates of Pending Litigation and other charges

A Certificate of Pending Litigation tells the world that someone has a claim against your property. The claim might be for payments owing under a defaulted mortgage, or for family law issues.

You have to clear this charge from title before you sell it.

It can take some time to sort out litigation issues, so start working on this right away.

Step Two: Think about Taxes

There are several kinds of taxes to think about when you are transferring or selling your home. It is extremely important that you speak with an accountant if you have any questions about any of these taxes.

Start thinking about these taxes when you list your home for sale. That will ensure you have enough money to pay them out of your sales proceeds.

GST

All property sales in Canada are subject to GST, unless that sale falls within an exemption.

The most common exemption people use when selling their home is the exemption for “used residential property”.

Used residential property might be a home that:

- you use as your principal residence

- you aren’t using for business purposes,

- isn’t a piece of inventory you are selling,

Determining whether your property is subject to GST is not a simple question. If you aren’t sure, you should get an accountant’s advice before you decide to list the property.

PST

The sale of residential property is generally exempt from PST in BC.

If you are selling goods at the same time you sell your home, you may need to deal with PST.

This might include selling equipment, tools or furniture.

Again, always discuss PST with an accountant if you are not sure whether PST applies in your situation.

Municipal Property Taxes

You must pay out any outstanding arrears for municipal property taxes. These can be paid before you sell, or we can pay them for you from your sales proceeds on closing.

As well, you must also pay any Land Tax Deferment Act Agreement charges registered on title to your property. We usually pay deferred property taxes from your sales proceeds. It’s important to know how much this amount will be, so you don’t fall short of funds on closing day.

If you won’t have enough money from your sale to pay these costs on closing, you must find the money somehow.

Vancouver Empty Homes Tax

Vancouver has a municipal bylaw which imposes a tax on empty homes.

Owners of Vancouver properties must file a declaration stating whether this property is their principal residence. If it isn’t, then they must pay a tax to the City of Vancouver.

This tax “runs with the land”. This means the City of Vancouver can ask the current owner to pay them, even if they were incurred by the seller.

You must make a declaration about this tax if the property is in Vancouver. Money might be held back from your sales proceeds until your buyer is satisfied that the taxes have been paid.

BC’s Speculation and Vacancy Tax

BC also has a new provincial tax called the Speculation and Vacancy Tax.

This tax applies to properties in a number of areas throughout the province. You must file a declaration if your property is in a taxation area. This declaration tells the provincial government if you are living in this property as your principal residence.

If you are using the property as your principal residence, you will likely be exempt from the tax. If you are not using the property as your principal residence, you may have to pay the tax.

This tax does NOT run with the land. This means the Province will come after you (even after you have sold your home) to pay any outstanding taxes.

Capital Gains

You must disclose the sale of property to the federal government in your income tax returns.

If you sell your principal residence, you may be exempt from capital gains taxes on that property. You may be required to pay capital gains taxes on the sale of investment property.

Non-Residency Issues

Here is a difficult topic – non-residency issues.

If you are a resident of Canada, that’s great. But if you live in another country (even if you are a Canadian citizen), your buyer must think about something informally called “non-residency taxes”.

Non-residency taxes are very complicated. If you are a non-resident, talk to an accountant well before you think about listing your home for sale. It can be very difficult to determine whether you are a resident of Canada or not. Residency is NOT the same thing as citizenship. You can be a citizen of Canada at the same time you are a non-resident.

Your buyer must, under the Income Tax Act, hold back a portion of the purchase price from you if they think you are a non-resident. They must hold these funds until you get a Compliance Certificate from CRA. this Certificate shows that you don’t owe any personal taxes with respect to the sale of this property.

It can take months to get a compliance certificate, so you want to start this process as soon as you can.

Step Three: Think about Timing before you list your home for sale

There are several timing issues you should think about when you are considering selling your home.

When your money will be ready from selling your home

It is quite rare that you will have the money from your sale – called the net sales proceeds – on the completion date.

There are several things which happen in the completion of a sale which are not in your control, and not in the control of your BC Notary or lawyer.

For example, if your buyer is using a mortgage, and their lender decides not to fund the mortgage until very late in the day, or even the next day, that will delay receipt of the funds significantly.

Your buyer can do everything their lender asks, and still encounter mortgage difficulties.

Money doesn’t transfer to us instantaneously. Trust accounting rules require certain steps in the movement of money, and that can take time.

Expect that the net sales proceeds will not be available to you on until at least the next business day, possibly longer.

Avoiding Back-to-Back Deals

If you are expecting to use the proceeds from your sale to fund the purchase of a new home, please make sure to give at least one day between the sale of your old home and the purchase of your new home.

This gives us enough time to make sure that we get the funds from your sale in time to pay for your new property.

If you can’t avoid arranging the completion of your sale and your purchase on the same day, please consider getting bridge loan financing for your purchase to ensure that you won’t have any difficulties funding your purchase.

Don’t Leave Town Just Yet!

Please make sure that you stay in town until your completion date.

If you have to leave town early, we will need to send documents to you for signature, and that will mean additional time and costs for meeting with a notary in that other location.

We will issue you a cheque for your sales proceeds in Canadian funds. If you are moving out of Canada, you will still need to deposit your money into a Canadian account. Don’t close out all of your accounts until you have processed those funds.

In Closing

If you are selling your home, have us or your Realtor pull a copy of your title before you list it for sale, so we can discuss these issues with you.

Talk to your accountant about which kinds of taxes you might have to deal with.

Looking at these issues before you list the property can save you a lot of time, cost and heartache on Closing Date.